Venturing into the dynamic world of foreign exchange trading can be both exhilarating and challenging. For aspiring traders, navigating the complexities of forex requires a solid understanding of fundamental concepts and strategic approaches. This beginner's guide aims to equip you with the essential knowledge to start your forex journey and potentially unlock profitable opportunities.

- First, it is crucial to grasp the basics of currency pairs, leverage, and market analysis.

- Following this, familiarize yourself with different trading methods such as scalping, day trading, and swing trading.

- Moreover, practice risk management techniques to reduce potential losses.

Concisely, successful forex trading requires dedication, patience, and continuous improvement. By adhering to these guidelines and developing a disciplined mindset, beginners can increase their chances of achieving profitable results in the forex market.

Forex Factory: Your Trading Intelligence Hub

In the ever-changing world of foreign exchange trading, staying ahead of the curve is paramount. That's where Forex Factory comes in as your ultimate resource. This comprehensive online community provides traders with a wealth of insights to improve their trading strategies. Whether you're a experienced trader or just begining your journey, Forex Factory has something to contribute.

- Access real-time market data, including charts, news feeds, and economic events

- Participate in lively discussions with fellow traders from around the globe

- Master trading strategies and techniques through expert forums and educational resources

- Discover forecasts to help you make calculated trading decisions

With its user-friendly interface and comprehensive features, Forex Factory empowers traders of all levels to navigate the forex market with confidence. Join today and unlock your full trading potential.

Conquering the Forex Market: Strategies for Success

Navigating the dynamic arena of the Forex market requires a blend of strategic insight. To prosper in this volatile environment, traders must cultivate a robust set of strategies that encompass risk management. A well-defined trading plan acts as the bedrock for success, guiding decisions and minimizing potential setbacks.

Furthermore, consistent self-improvement is paramount. Staying abreast of market fluctuations and financial news empowers traders to make prudent judgments.

- Portfolio Allocation

- Emotional Control

- Leverage Management

By embracing these key principles, traders can significantly boost their chances of achieving long-term returns in the Forex market.

Navigating the Forex Labyrinth: Risk Management Essentials

Embarking on a forex trading journey is an exciting prospect for aspiring traders. Yet,, the inherent volatility of the market demands a comprehensive risk management strategy. To succeed in this fluctuating environment, traders must cultivate prudent practices that minimize potential losses. A well-defined risk management plan serves as a fundamental framework, helping traders traverse the forex labyrinth with assurance.

- First and foremost, it is imperative to determine a well-defined risk tolerance level. This involves honest self-assessment of your personal capacity for risk.

- Secondly, always apply stop-loss orders to cap potential losses on each trade. A stop-loss order is an predetermined instruction that activates a sell order when the price falls below a specified level.

- Lastly, diversify your portfolio across different currency pairs. This reduces the impact of any isolated market movement on your overall results.

Bear in mind that risk management is an continuous process. Periodically review and refine your strategy as market conditions change. By embracing a disciplined approach to risk, you can enhance your chances of profitability in the forex market.

The Art of Scalping in the Forex Market

Scalping within the volatile landscape of forex trading demands a unique set of skills and strategies. It's not for the faint of heart, as scalpers seek to capitalize on minute price fluctuations, often making dozens of trades per day. A keen eye for patterns, lightning-fast decision execution, and unwavering discipline are vital to this high-pressure methodology. Scalpers rely on technical tools to identify fleeting windows for quick profits, entering trades within seconds and exiting just as rapidly. The goal is to accumulate small wins that snowball over time.

High-Impact News and Its Influence on Forex Trading

The forex market, a global network of currency exchanges, operates relentlessly 24 hours a day, five days a week. While technical analysis and fundamental analysis are crucial in shaping trader decisions, high-impact news events can cause sudden shifts market sentiment and currency prices. Geopolitical developments, economic reports, and central bank statements are prime examples of such events that can trigger sharp fluctuations in the forex market.

forex factory newsMarket Participants closely monitor these news sources to gauge potential trends in currency values. Upbeat economic news often leads to a strengthening of the related currency, while negative news can cause depreciation.

Consider this, an unexpected interest rate hike by a major central bank can send shockwaves through the forex market, leading to a rapid rise in the value of that region's currency.

- Consequently, staying informed about high-impact news events is essential for forex traders who aim to exploit market changes.

- Prudent trading strategies become even more critical in a dynamic market environment influenced by news events.

Romeo Miller Then & Now!

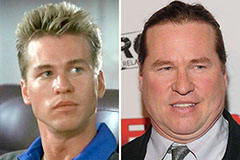

Romeo Miller Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now! Erika Eleniak Then & Now!

Erika Eleniak Then & Now!